Everything You Need to Know About Retirement Planning

Everyone knows that retirement planning is essential and that the earlier you start, the better. But it’s shocking how few start saving for retirement in their 20s–a whopping 39%. Some people even wait to start saving once they’re in their 50s. Although we don’t recommend waiting this long, it’s always better to start saving today than to dwell on the past.

Whether you’re in the saving and planning grind or just starting your retirement savings journey, here’s what you need to know.

Determine How Much Money You Need Each Year You’re Retired

To save for retirement, you must have a monetary goal. Although it would be great never to have to worry about money, most retirees must live on a budget to ensure their retirement savings last long enough.

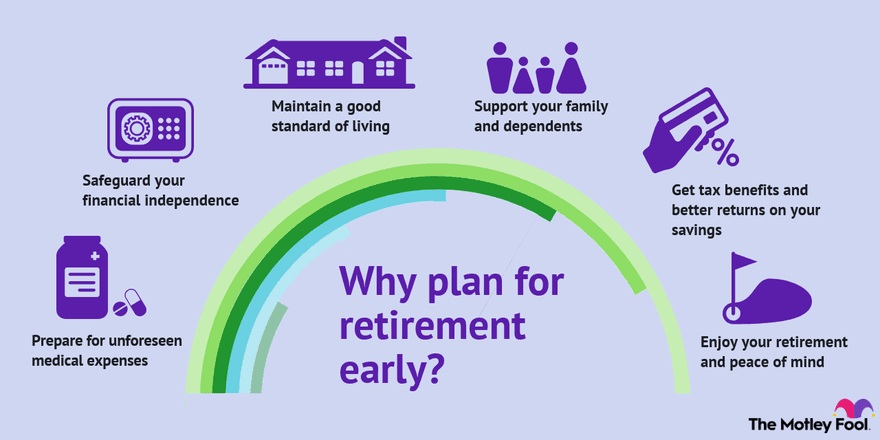

Image Source: https://www.fool.com/retirement/

Although your income can change throughout your life, especially if you’re starting your retirement planning early, plan to save 70-90% of your monthly income for each year in your retirement account. In other words, if you make $50,000/year, you want to live each year in retirement on approximately $40,000 (80% in this example).

Knowing how much you need for each year of retirement helps you find retirement plans that best meet your goals and needs.

Find Retirement Plans That Work for You

There isn’t a single retirement account available that’s better than others for you–they all have their benefits, which is why you need to work with a financial advisor and lawyer to determine which retirement accounts help you the most.

Many companies offer employer sponsored retirement plans, like 401Ks, but that shouldn’t be your only retirement savings account. Additionally, some businesses don’t offer this kind of planning at all.

Regardless, you should seek other options to help you build a retirement planning portfolio. Consider these plans with your advisors and lawyers:

- 401(k)

- Roth IRA

- Traditional IRA

- Self-directed IRA

- Simple IRA

- SEP IRA

- Solo 401(k)

Some of these plans are tax deductible, have low interest rates, and earlier accessibility dates. Using multiple retirement plans helps you be conservative in some plans while attempting a more aggressive option with others.

Select Your Plans and Start Saving Today

Once you find what works for you and your future, commit to those plans. If you’re married, ensure your spouse sets up their individual retirement accounts alongside you. Working together doubles your retirement income and gives you an accountability partner throughout the process.

Commit to saving retirement money every month and stay motivated. Although it might be easy to skim a few dollars here and there from your committed pile of cash before it goes into a retirement plan, please don’t do it.

Depending on your age, those few dollars can turn into hundreds, thousands, and even millions after several decades. Those few dollars will benefit you greatly during retirement age.

Conclusion

There are dozens of options available when looking for retirement plans. Whether you’re in your 20s or starting to save in your 50s, Hickey and Hull can help you make the best financial decisions for your future estate.

Call us or visit today to learn how we can help you get on the right track with your estate and finances so that you can enjoy retirement.